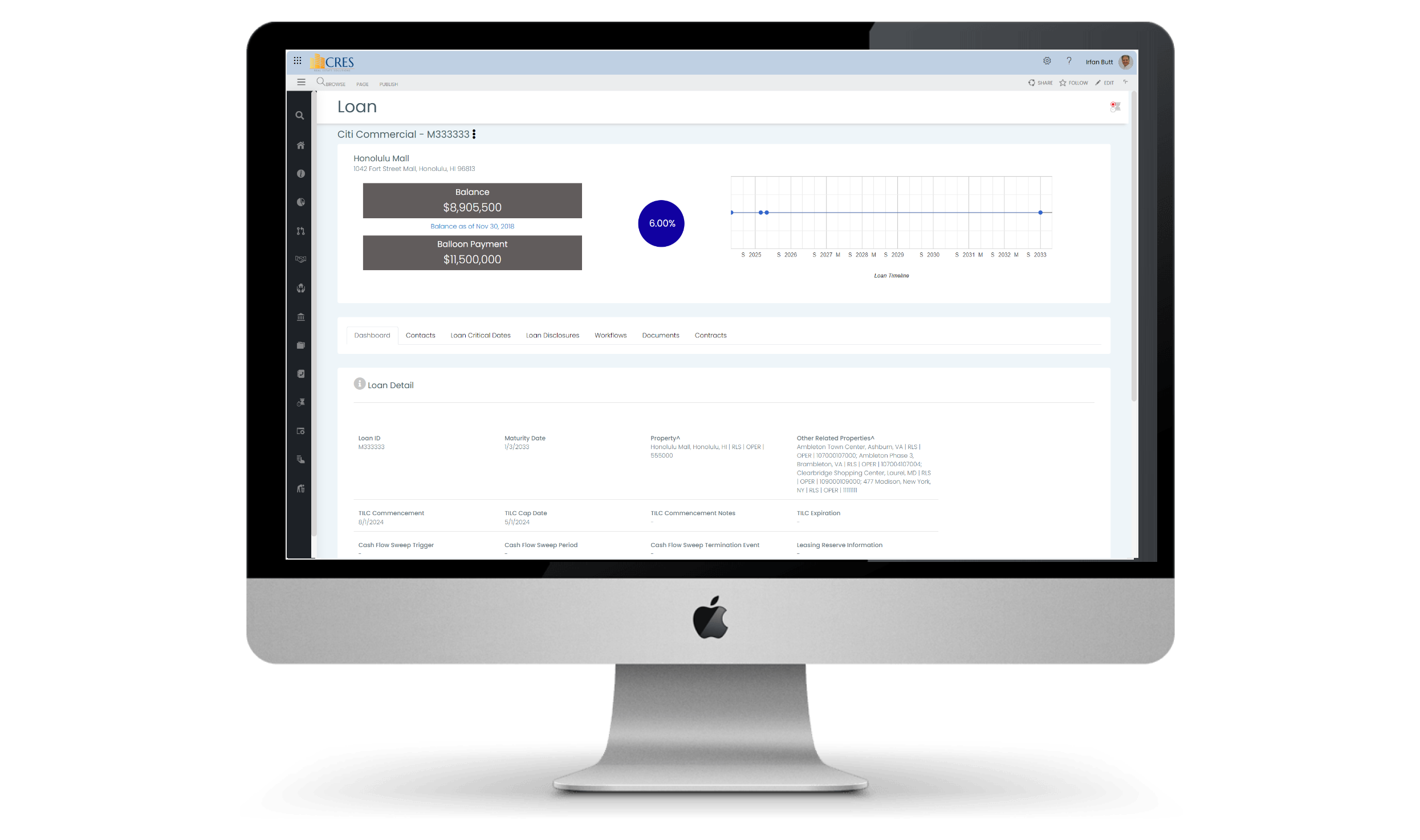

CRES Real Estate Loan Management

An automated solution to easily manage your loan information, documents, critical dates, and business processes

An automated solution to easily manage your loan information, documents, critical dates, and business processes

Commercial real estate loan management involves navigating various technical and operational challenges. To execute well, borrowers must handle complex data sets, integrate multiple systems, meet critical deadlines for risk management, while ensuring cybersecurity. Achieving streamlined, secure, and user-friendly loan servicing often requires integrated systems and ongoing maintenance.

Loan management process is easier with CRES. It integrates with any financial system, while maintaining a single source data. CRES centralizes management of loan critical dates, mortgage and amortization schedules, as well as key terms, and documents. It benefits from CRES Process Automation, which utilize Generative AI and Robotic Process Automation to streamline Loan Management. You can automate loan agreement data extraction to drive mundane and accurate data entry in internal and external system.

Seamlessly integrate with loan data from MRI, Yardi, or any other source system. CRES seamlessly helps manage your business processes and documents. Automated workflows supported with employee assignments and business processes.

CRES Process Automation streamlines routine loan management processes, including those related to multiple critical dates. It enables you to easily create any workflow using an AI-based wizard. Additionally, CRES performs AI-based loan document data extraction, facilitating robotic process automation for accurate and mundane data entry in both internal and external systems

A single real estate loan can have multiple critical dates, each requiring Process Automation. Mitigate risks and remove administrative headaches, with automated loan critical date management. Always stay on top of due dates by receiving reminders, compliance emails, and auto-triggered workflows.

Manage external contacts list integrated with your loans and email system. Conveniently locate contacts such as attorney, loan servicer, or mortgage contact when reviewing loans in CRES.

Track and manage loan issues in a centralized location. Attain management visibility and debt related compliance across portfolio.

Investment Committee approvals are an integral part of any commercial real estate organization. CRES simplifies approvals by allowing multiple approvers to review and approve the request with a simple click within an email message on their smart phones or workstations.

Seamlessly integrate with loan data from MRI, Yardi, or any other source system. CRES seamlessly helps manage your business processes and documents. Automated workflows supported with employee assignments and business processes.

A single real estate loan can have multiple critical dates, each requiring Process Automation. Mitigate risks and remove administrative headaches, with automated loan critical date management. Always stay on top of due dates by receiving compliance emails, and auto-triggered workflows.

During loan management process, you may come across issues that need to be addressed. With CRES, you can track and manage loan related issues in a centralized location. System alerts for issue resolution and sends compliance emails. This also helps attain management visibility.

CRES Process Automation streamlines routine loan management processes, including those related to multiple critical dates. It enables you to easily create any workflow using an AI-based wizard. For Management Investment Committee, Cress provides 1-click Approvals via Email. Additionally, CRES performs AI-based loan document data extraction, facilitating robotic process automation for accurate and mundane data entry in both internal and external systems

Manage external contacts list integrated with your loans and email system. Conveniently locate contacts such as attorney, loan servicer, or mortgage contact when reviewing loans in CRES.

Investment Committee approvals are an integral part of any commercial real estate organization. CRES simplifies approvals by allowing multiple approvers to review and approve the request with a simple click within an email message on their smart phones or workstations.

No matter which source system you use, MRI, Yardi, VTS, RealPage – cloud, or on-premise, CRES can be integrated with any property management system. Our state-of-the-art Data Integration Service requires no physical interface. Using tons of available connectors, we can seamlessly integrate your business processes across your systems and applications.

Google Drive

FTP

SMTP

Dynamics 365

Salesforce

Power Automate

Slack

Box

OneDrive

Microsoft Forms

Microsoft Planner

Microsoft Teams

Common Database

SQL Server

Microsoft Todo

Power BI

Office365 User

Yammer

Approvals

Azure Application

Power Apps

Adobe Sign

DocuSign

Azure Data Lake

Office365 Group

Bing Maps

File System

Notifications

Project Online

Azure AD

Office365 Outlook

SharePoint

Microsoft To-Do

CRES is a great PropTech company. We have been engaged with them since 2012. During these years they have managed our support very professionally. CRES Real Estate Solutions software has been very useful in managing our data, documents, business processes, and business intelligence. We're further exploring their integrated Workflow Automation Solution to streamline our business processes and facilitate due diligence. They are a professional and reliable IT organization. I would definitely recommend CRES Real Estate Solutions to our peers in the industry.

We were looking for a software solution that was easy to integrate with existing systems and would allow centralized viewership of data. CRES has been that solution. CRES not only provided a unique solution to our problem but has also kept our costs significantly lower. CRES Technology has not only been a great solutions provider but has also become a great business partner.

I can say without a doubt, that acquiring your services was a good decision. With your help, we have come a long way toward truly embracing technology. Your business acumen in our industry has been particularly helpful in streamlining our business processes and making us more efficient.

Thanks for helping us adopt SharePoint, by developing a tool that captures our Asset Life Cycle so effectively. We love the new Deal Sheet report which is so much better than what we were using in the past.

You have done a great job in transitioning us towards a paperless office. The development of the Legal Entity Management Tool is a great accomplishment that allows us to see all relevant information and documents for any legal entity on one web page.

Head Office: New York, USA

Other Locations: Houston, Dallas, Chicago, Los Angeles