If you’re a legal professional serving the real estate industry, you must be well aware of some of the difficulties of legal entity management. Chances are, your organization uses paper, or electronic files such as Excel, Word, or PowerPoint, etc., to keep track of legal entities. Even if you have invested in a generic legal entity management tool, it may not be integrated with your real estate system and documents. Documents may be scattered across multiple environments, may not be linked to your data, and are difficult to share internally and externally. Your organization has to juggle lots of real estate and corporate contracts, all without a well integrated contract management system. You or your colleagues need to manage plenty of deadlines related to legal entity compliance. In this blog, we will review some of these challenges, and what we can do to manage them well.

Real estate companies form legal entities to achieve business objectives and manage risk. To protect investors and operators, typically a real estate legal entity is created for a single,- or in some cases, a small number of properties. This also allows investors to easily invest in specific properties. On the financial side, this structure allows for allocation of P&L and balance sheet line items and entries, specific to a unique legal entity and its corresponding properties. Without legal entity management, your legal entity is just a filing in a government office – important, but not enough.

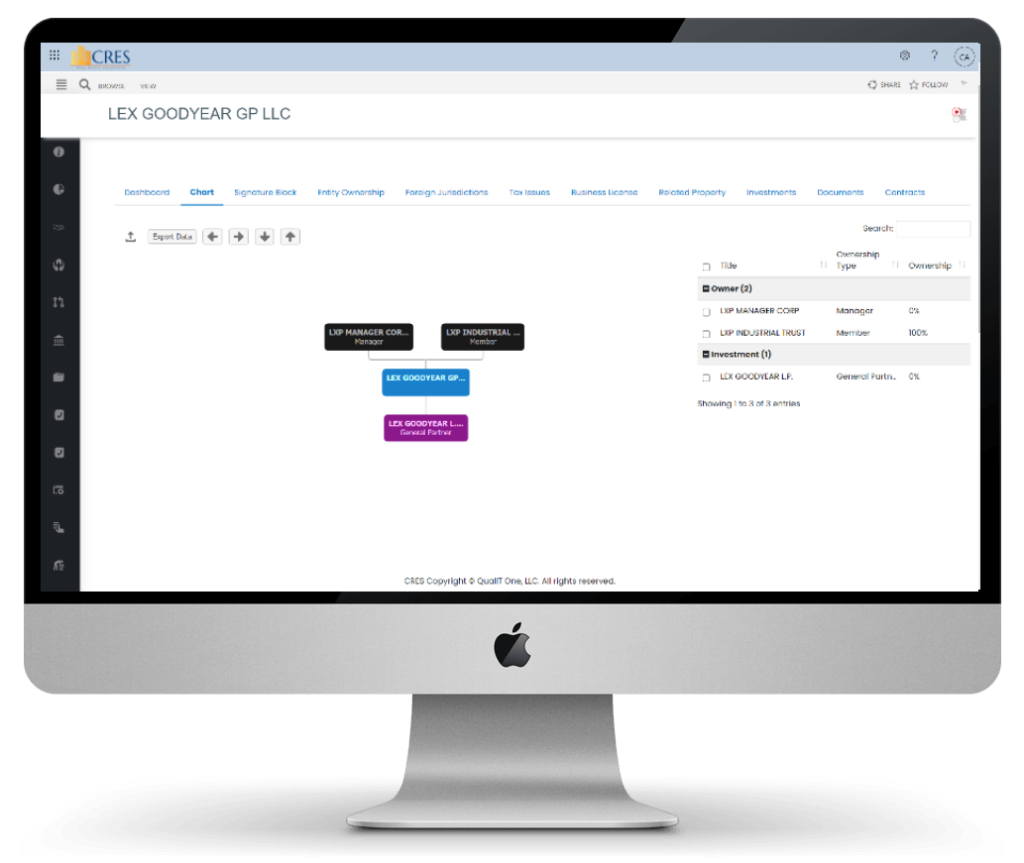

1. Complex Ownership Structure

The ownership structure of real estate entities can be quite complex, based on investor and tax requirements. A given legal entity can be owned by other legal entities with specific ownership percentages and ownership types. What makes this structure more complex is the fact that over time the relationship between legal entities may keep evolving as investors change their ownership stake and acquire interest in other legal entities which may already have an interest in a given legal entity. To maintain the entity relationships organizations often use hand drawn org charts, which are often inaccurate. Even broadly available entity org chart tools often fall short in keeping up with this complexity, which results in lost time and effort in legal departments. Furthermore, outside investors require access to this data, and there can be an issue in sharing data related to entity ownership structure.

2. Too many Jurisdictions and Compliance Requirements

Entities often need to be registered in multiple jurisdictions, each having their own set of compliance requirements–such as timely filing of annual reports. A proper legal entity management solution must include the ability to grant relevant people access to important information and store this data in a centralized location. This is often lacking and can result in an increase in administrative costs and risk for the organization. For example, organizations require relevant people to be notified when compliance steps need to be taken, in a timely manner.

3. Lack of Integrated Document Management

Document management is a critical component of legal entity management. There are plenty of various legal entity document types (we can count around 50), including organizational documents, filings, important agreements, and insurance policies, etc. Many of these documents have corresponding critical dates, that need to be monitored and tracked. For example, most contracts require critical date alerts. Effective legal entity management, not only needs to store these documents in a centralized location, but also be able to share and collaborate for the creation, review, approval, signature routing, and archival of these documents in a safe and secure manner.

4. Lack of Real Estate Portfolio Integration

There are many generic legal entity management tools available, but they all seem to fall short–not only because they don’t handle many of the above mentioned challenges well, but also because most of them are not specific to the real estate industry. For ideal real estate legal entity management, such tools must be integrated with the organization’s other real estate systems. The true real estate portfolio integration with legal entities can only be accomplished when legal entities are tied to real estate data, documents, and business processes.

How can we help?

CRES Technology is a real estate IT services company, and with our vast experience in the real estate industry, we have developed a real estate portfolio management solution, called CRES. In addition to a host of other capabilities for real estate companies, CRES includes a robust feature of Real Estate Legal Entity Management. CRES is built for the unique needs of the real estate industry and is implemented on Microsoft Office 365 Cloud. Since a vast majority of real estate companies are already using or migrating to Office 365 platform, implementing CRES makes sense. CRES addresses all of the challenges of real estate legal entity management. It integrates well with all popular real estate systems, including MRI, Yardi, VTS, and RealPage. To learn more about this solution, please contact us and visit CRES.

About Irfan Butt

CRES Technology – Founder and CEO

A strategic leader with more than twenty years of progressive experience in Business Administration, Finance, Product Development, and Project Management. Irfan has a proven track record with broad range of industries including hospitality, real estate, banking, finance, and management consulting.